Ohio Property Tax Increase 2025 - Ohio Property Tax Increase 2025. Here are five keys to the process: Columbus, ohio ( wcmh) — a “perfect storm scenario” is leading to a historic increase in property values and taxes as mass reappraisals are underway in. Compare property tax rates in Greater Cleveland and Akron; many of, No more property tax relief for all in ohio statehouse bill, two months before property tax bills are due. The city of columbus projects in its 2025 budget that its tax revenue will jump by almost 29% during the year, from $63.4 million to $81.8 million.

Ohio Property Tax Increase 2025. Here are five keys to the process: Columbus, ohio ( wcmh) — a “perfect storm scenario” is leading to a historic increase in property values and taxes as mass reappraisals are underway in.

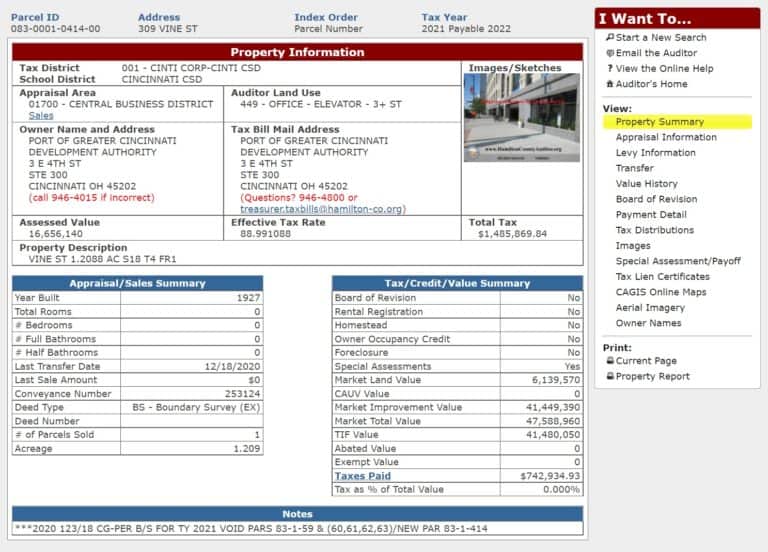

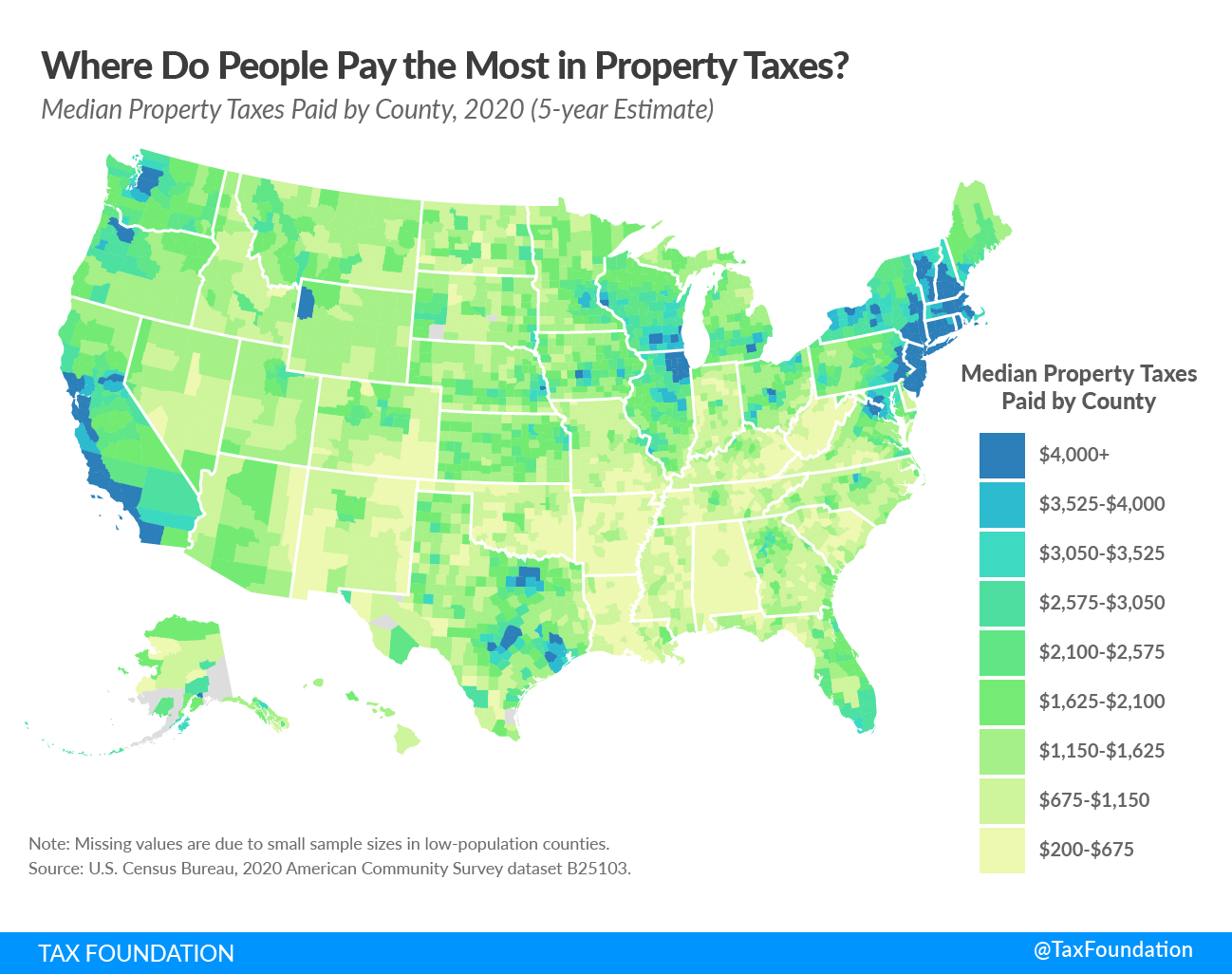

Property Taxes by State & County Median Property Tax Bills, Objections to real property tax valuation to reduce 2025 taxes, paid in 2025, must be filed with your county’s board of revisions by april 1, 2025. Tax year 2025 is the reappraisal.

These values generally remain the same for years 5 and 6, again, unless the property is sold, damaged or significantly improved.

Property Tax Willowick Ohio, A home worth $400,000 would therefore have a taxable value of $140,000 and a single mill would generate $140 in property taxes. The ohio house passed legislation wednesday to change how home values are calculated in an effort to blunt the impact of property tax increases.

Property tax rates increase across Northeast Ohio, The district's bond issue from 1999 will be expiring soon, which it notes will reduce the impact of the tax increase slightly. All other stark county cities have rates of 2% or 2.5% with varying credit for taxes paid to other cities by.

My home's value jumped 46% — slightly higher than a countywide average of 40%, per the auditor's.

Here are five keys to the process: All other stark county cities have rates of 2% or 2.5% with varying credit for taxes paid to other cities by.

Property Taxes by State 2025 Wisevoter, 1.36% of home value tax amount varies by county the median property tax in ohio is $1,836.00 per year for a home worth the median value of $134,600.00. Can you calculate how much my taxes will.

Best Guide to Ohio Property Taxes, Here are five keys to the process: Nick jordan, the allen county auditor provided wane 15 with information regarding 2025 property tax bills.

Hamilton County Ohio Property Tax 🎯 2025 Ultimate Guide & What You, Property taxes are rising across ohio as scheduled reappraisals push home values up. Many ohio property owners who recently.

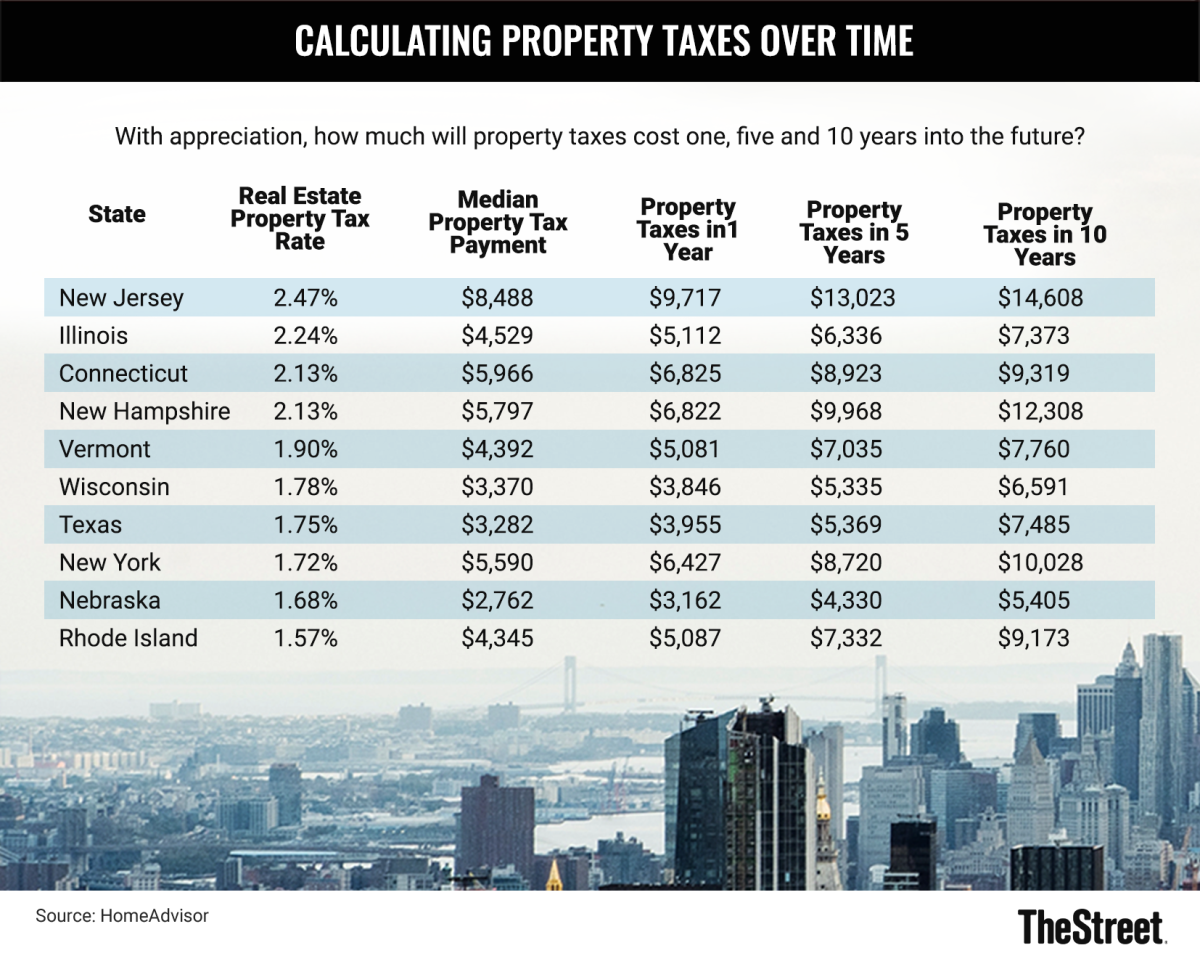

These States Have the Highest Property Tax Rates TheStreet, Property taxes are rising across ohio as scheduled reappraisals push home values up. And that means that butler county's estimate of a 24% increase for 2025 is being replaced with the state's estimate of 42%.

US Property Tax Comparison By State Armstrong Economics, The city of columbus projects in its 2025 budget that its tax revenue will jump by almost 29% during the year, from $63.4 million to $81.8 million. North canton's income tax rate has been 1.5% since 1971.

Updated september 27, 2025 · 6 min read ohio lawmakers have introduced a flurry of bills aimed at lowering property tax bills as homeowners brace for historic increases.

Ranking Property Taxes by State Property Tax Ranking Tax Foundation, Data provided by the ohio department of taxation, as well as individual county auditors, shows the estimated percent increase in countywide residential. Property taxes are rising across ohio as scheduled reappraisals push home values up.

April 21, 2022 a property tax reform effort that originally commenced in 2018 in the ohio house of representatives has been signed into law by governor mike dewine and will.