Nj Income Tax Brackets For 2025 - Why Significant, Lasting Property Tax Reform is So Difficult New, Enter your details to estimate your salary after tax. New jersey's 2025 income tax ranges from 1.4% to 10.75%. Understanding 2025 Tax Brackets What You Need To Know, You can estimate your 2025 srp payment. You cannot calculate your srp precisely until you have filled out.

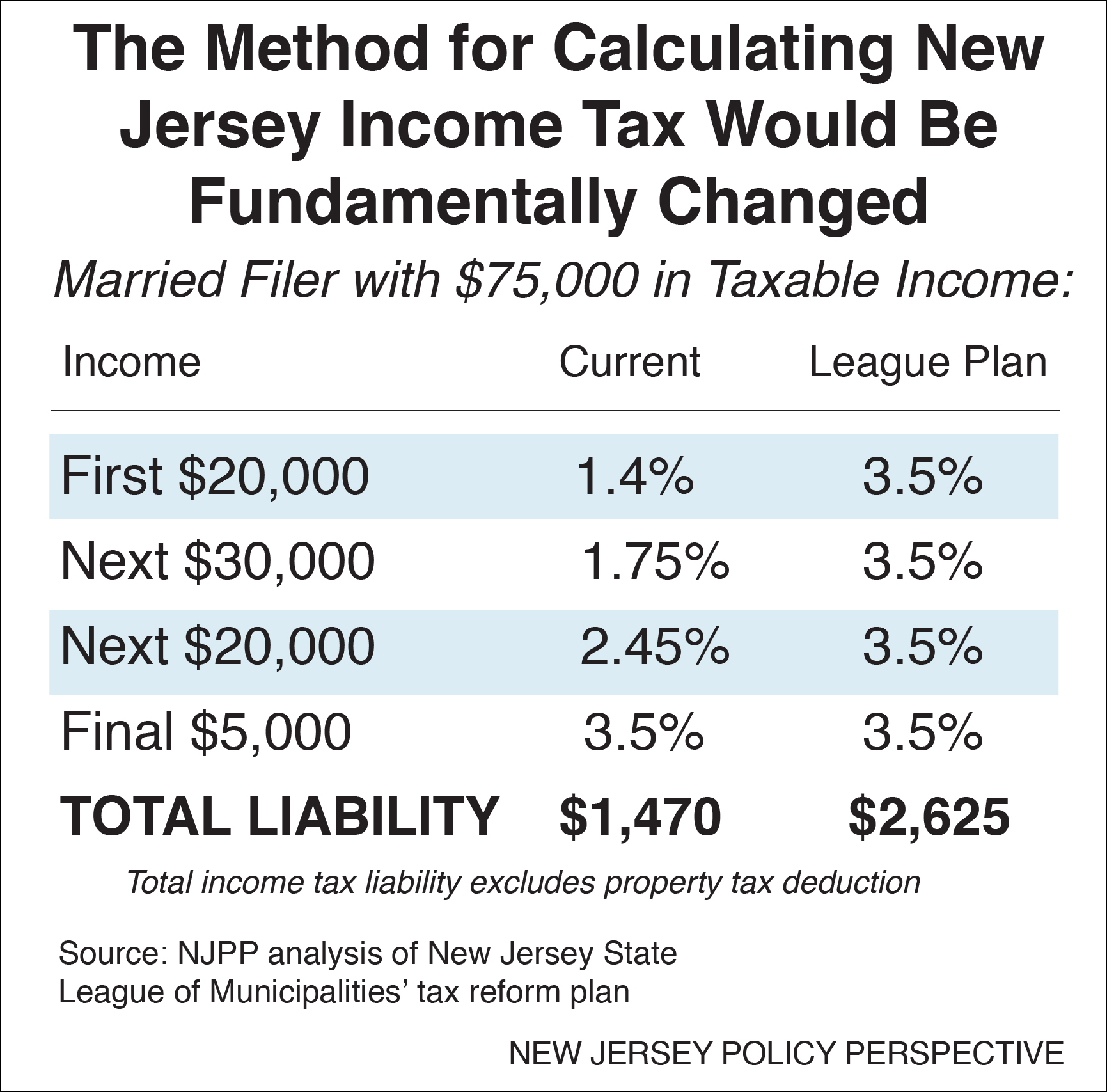

Why Significant, Lasting Property Tax Reform is So Difficult New, Enter your details to estimate your salary after tax. New jersey's 2025 income tax ranges from 1.4% to 10.75%.

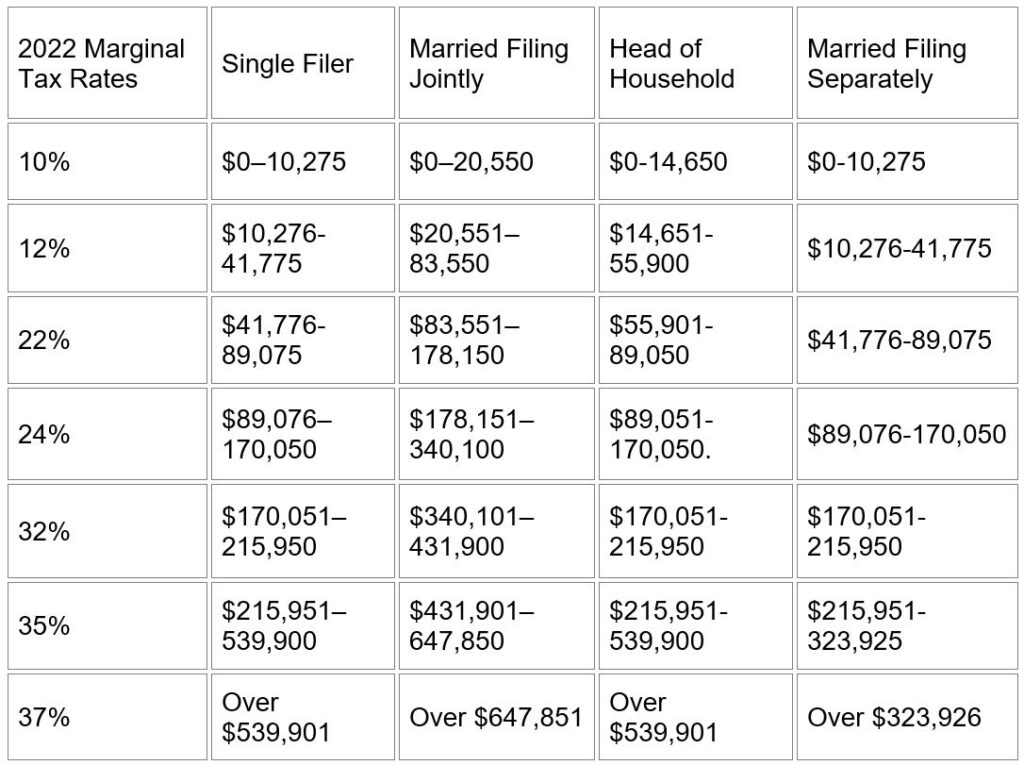

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Nj Income Tax Brackets For 2025. Taxable income (single filers) tax rate on this income; The federal income tax has seven tax rates in.

2025 Tax Brackets The Best To Live A Great Life, See current federal tax brackets and rates based on your income and filing status. The internal revenue service (irs) on thursday released updated tax brackets and standard deductions for 2025.

Reforming New Jersey’s Tax Would Help Build Shared Prosperity, This page has the latest new jersey brackets and tax rates, plus a new jersey income tax calculator. The internal revenue service (irs) on thursday released updated tax brackets and standard deductions for 2025.

2025 Bracket Matrix Calculator Helge Brigida, The federal income tax has seven tax rates in. While this handbook focuses on the law applicable to the filing of income tax returns in 2025 for the 2025 tax year, legislative changes effective after 2025 are also.

What Are Tax Brackets, New jersey residents state income tax tables for single filers in 2025 personal income tax rates and thresholds; 2025 marginal tax brackets your marginal tax bracket determines how much of the earnings from savings and investments you get to keep after taxes.

New jersey has eight marginal tax brackets ranging from 1.4% to 10.75%;

For taxable incomes between $150,000 and $500,000, the married filing jointly rate is. New jersey’s income tax is structured similarly to the federal income tax.

NJ takes another look at tax bracketing NJ Spotlight News, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The new jersey tax calculator includes.

2025 State Tax Rates and Brackets Tax Foundation, For a new jersey resident that files their tax return as: Use our income tax calculator to find out what your take home pay will be in new jersey for the tax year.

22 Questions Answered for 2022 Tax Filing Emerald Advisors, New jersey — the internal revenue service has introduced new income limits for seven tax brackets for 2025, adjusting thresholds to account for inflation. The salary tax calculator for new jersey income tax calculations.

Tax rates for the 2025 year of assessment Just One Lap, Home > state tax > new jersey. New jersey’s income tax is structured similarly to the federal income tax.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Updated for 2025 with income tax and social security deductables.